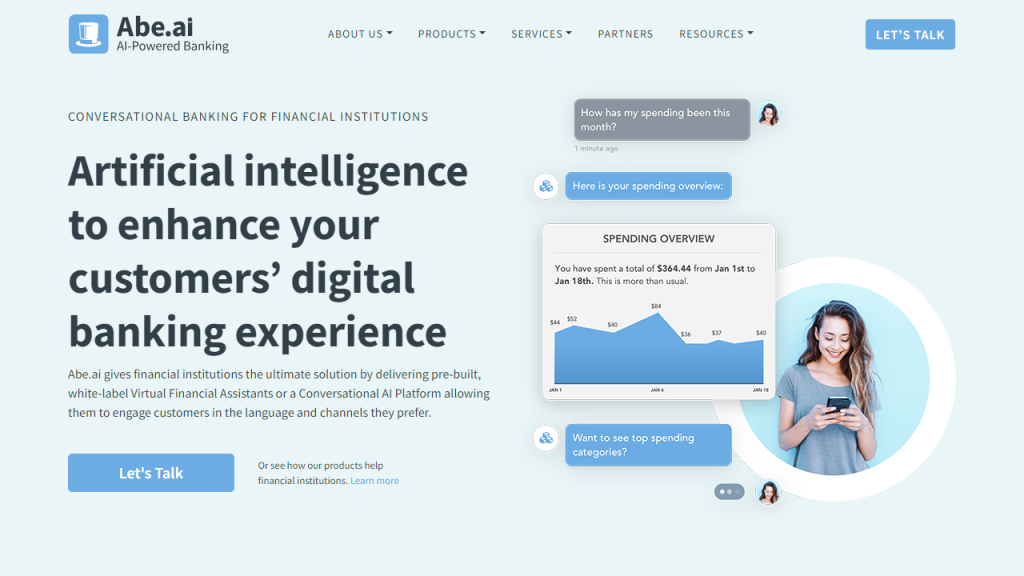

Abe AI offers AI-powered banking solutions for banks and credit unions to provide world-class customer service, streamline operations, and drive profitable growth. The company provides a Virtual Financial Assistant or a Conversational AI Platform that can be customized as per the financial institution’s requirements. This allows them to engage customers in the channels and languages that they prefer, ultimately promoting both customer and operational efficiency. The Virtual Financial Assistant (VFA) helps in financial wellness for consumers, guiding them with relevant personalized interactions and self-serving capabilities. Similarly, the Conversational AI Platform empowers financial institutions with fully featured products, giving them better customer experiences and increasing operational efficiency. Abe AI’s technology is built keeping in mind for banks, credit unions, and wealth managers. It provides a personalized Natural Language Understanding and advanced machine learning techniques to create a more engaging dialogue and better language understanding. Abe AI’s technology can be integrated with existing and new security protocols to ensure secure and private interactions across all channels, making the entire digital banking experience simpler and better. Overall, Abe AI offers a powerful tool for financial institutions to enhance their customer’s digital banking experience while improving their own operational efficiency and data insights.